7 easy ways to manage your money and save more

![[object Object]](http://images.ctfassets.net/ly25iagmtxce/4U6wZs14oy8TKgPM5oGrit/d74f3b02141fac59384024f4c27a0acd/andre-taissin-Dc2SRspMak4-unsplash.jpg)

Photo by Andre Taissin on Unsplash

The global economy hasn’t fully recovered from the impact of Covid. Jobs were lost, and companies downsized while many shut down. The world was on the brink of a total breakdown as many people were forced to survive on their savings (for those that had any) and others on the government's goodwill (grants, subsidies, and relief funds). At the pandemic's peak in 2020, American household debt increased to $14.3 trillion. The bulk of this debt was caused by poor money management decisions and abilities that were already a time bomb waiting to explode. Covid was only the trigger.

One lesson the events from the last couple of years taught us was the importance of money management and financial planning. According to the National Financial Educators Council, the average US resident lost $1,634 in 2020 and $1,389 in 2021 due to financial illiteracy and poor financial management skills.

And while most people think managing finances is the next easiest thing after reciting the alphabet, the facts say otherwise.

If you want to learn how to manage your finances effectively, this guide is for you.

Steps you can take to manage your income

Here are seven important steps to help you cut expenses and have more money in your pocket.

1. Assess your cash inflow and outflow

The first step in managing your finances is assessing and evaluating your means of income. Here, you must be as honest as possible as you identify and acknowledge your cash inflow, including all jobs, businesses, and other investments that give you a regular income. Calculate all your cash inflows and write down how much you earn monthly.

Next, have a list of all your monthly expenses, including rent, utility, groceries, transportation, debt, etc. This gives you an idea of how much you earn and how much you spend monthly. With this information, you will gain knowledge of your financial situation and can start plotting a recovery plan if necessary.

2. Establish your financial objectives

Next, you must establish your financial objectives and have them at the forefront of your mind. You can write these objectives out and evaluate whether your current financial condition resonates with your plans. For instance, you can’t be earning $2000 monthly and yet plan for a summer holiday trip that would cost $22000.

Clarifying your financial goals can simplify the process of developing a workable budget. Your financial objectives can include short-term and long-term plans, but they must reflect your true paycheck.

3. Always make a budget

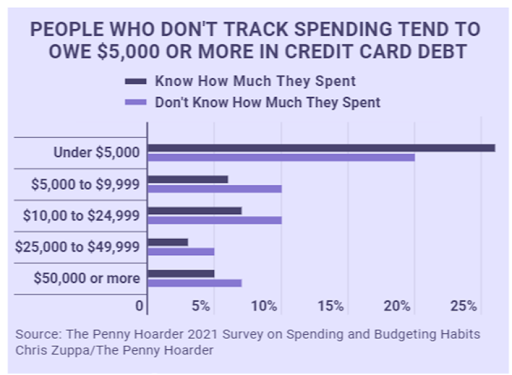

According to a study, over 55% of Americans do not make budgets to manage their finances. Most of those who do not make a budget do not keep track of their monthly expenses and cannot account for them. Interestingly, the report asserts that people who don't track their spending are likelier to have credit card debt of $5,000 or more.

Creating a budget that outlines how your money will be spent each month might be simple. However, adhering to it is frequently difficult. People could lack the self-control to avoid making impulsive purchases or feel overly constrained by having to budget their money.

However, budgeting is one of the best money management strategies to organize your finances. Sticking to your budget helps you save and avoid unnecessary expenses.

4. Create a fund for emergencies

Everyone needs emergency savings. Maintaining a reserve of funds for unforeseen circumstances like a damaged automobile, illness, or lost job is a key component of successful money management. A 2021 Bankrate study reveals that only 39% of Americans have enough funds to meet a $1,000 emergency. The studies further indicate that one in every four Americans said they had more credit card debt than in an emergency fund.

Experts advise that your emergency fund should be at least three months of expenses. That is, if you have a monthly budget of $500, your emergency fund should be at least $1500.

Savings are the greatest way to start this fund, so include them in your spending plan. Depending on how much additional cash you have, you can save more or less, but as a general rule, you should set aside 10% of your monthly salary for emergency savings.

5. Save for the future/retirement

Everyone will retire from working at some point, but doing so without retirement savings will be disastrous. Social Security benefits replace only about 40% of your salary, and many employers no longer provide pensions. The 2021 SimplyWise Retirement Index indicates that 23% of Americans have no retirement plan. Other reports suggest that about 50% of Americans have less than $100,000 saved up for retirement; unfortunately, this amount won’t be sufficient.

Due to automated salary deductions, workplace retirement plans like 401(k) accounts can be a smart way to save for retirement.

6. Stay away from debts and repay existing ones

First, you'd need to get rid of debts to know how to manage your finances effectively and save money. Meeting financial objectives can be difficult when you have debt, and paying off debts can be challenging. Household debt in the US in the first quarter of this year rose to 15.84 trillion; this includes mortgage and car financing. Increasing debts is partly the reason for a poor saving culture. And don’t forget, you’ll have to pay extra interest when you take a loan.

Always strive to void debts as much as possible. If you are going to take a loan for a non-essential, you would rather avoid the loan and make plans in your next budget to finance that expense.

7. Have multiple streams of income

It is not smart to rely on only one income stream; anything could go wrong any time, and you will be out of cash. Multiple cash flow streams provide extra financial security, help you save better, and avoid debts.

Here are a few ideas to diversify your income

Taking on more jobs: This enables you to earn wages from more than one place. However, ensure that it is convenient and that one job doesn’t affect your performance at the other.

Rental income: In this case, you would purchase or construct a rental property and collect rent from the tenants to supplement your income. The fact that this source is passive means that you will have to focus much less on it.

Interests: Many banks and financial institutions offer interest on any deposit you make in a savings account. Research the best offer available in your city and start earning from your savings.

Side hustle: This can be a small business you do on the side that doesn’t take much of your time but brings in some income. It could be freelancing, drop shipping, or simply offering a service in your free time.

While you do your business as a freelancer or an independent contractor, you must know how to manage your finances effectively. Doing this would help you grow your business and keep up with tax payments. Automated tools make it easy to manage your business finance; a good example is Workee.

Workee is an automated solution that enables you to manage your business effectively by providing finance, payments, booking, communication, and personal website functions.

Finance: With workee, you have a complete finance management tool that includes automatic invoicing, manual invoicing, tax calculations, etc.

Payments: Workee integrates seamlessly with Stripe to allow you to take client payments.

Booking: Clients can book you and schedule sessions with you using Workee. The software also provides reminders and allows you to send automated emails.

Communication: Workee allows you to communicate and collaborate with clients through video calls or instant messaging.

Personal website: Signing up on Workee allows you to have a personal website in 5 minutes or less. Workee builds a website for your brand with your unique URL. You only need to customize it to your taste, which doesn’t require code experience or technical knowledge.

Wrap up

Changes in personal behavior are the first step toward managing your money more effectively. You have to learn to cut down on unnecessary expenses, save before spending, and always make a budget and stick to it. Doing this, alongside the abovementioned tips, will teach you how to manage your finances better.