How to manage your small business expense like a boss

![[object Object]](http://images.ctfassets.net/ly25iagmtxce/7u3ycrOHNS80EP3vyiSDJH/b05fde07154b48af8e5a0bf007bde411/pexels-karolina-grabowska-4968630__2_.jpg)

Photo by Karolina Grabowska on Pexels

In the adventure of managing your business day in and day out, it's easy to overlook the importance of closely monitoring your expenses. Yet, keeping a finger on the pulse of your business finances is like having a crystal-clear window into its overall health and performance. It enables you to identify growth opportunities, make informed decisions, and tighten the purse strings when necessary.

But let's face it: tracking business expenses can feel like an overwhelming and time-devouring task, pulling you away from the smooth operation of your business. But not to worry, in this Workee guide, we're diving deep into the world of small business expense tracking. We'll uncover what it really entails and, more importantly, equip you with effective strategies to streamline and conquer this essential task. So, get ready to dive in with us.

Understanding business expense tracking?

Small business expense tracking goes beyond simply keeping a record of receipts and categorizing costs. It's like having a financial compass that guides you through the intricate maze of your business finances. By seamlessly integrating this information into popular accounting software, you can effortlessly manage payments to employees and vendors, making your financial transactions a breeze.

But the benefits don't stop there. Mastering the art of tracking business expenses unlocks a treasure trove of insights. It unveils the true pulse of your business, revealing profits, losses, and invaluable trends. Armed with this knowledge, you can boldly chart your course and make informed forecasts, ensuring a steady and prosperous journey ahead. After all, knowing where your money goes empowers you to wield it responsibly and strategically.

And let's not forget the added bonus of impressing the IRS! The IRS accepts business expenses as deductible when you have proper documentary evidence to support them. When you track business expenses, you can better organize and maximize your tax deductions when the time comes. Consequently lowering your organization's taxable business income.

Whether you are a sole proprietor or have a single-member LLC, you can deduct various business expenses, such as software subscriptions, office bills and utilities, and expenses related to business travel.

How can small businesses track their expenses?

Keeping a finger on the pulse of your business expenses involves a series of steps that you can follow to effectively manage your financial records. In five steps, we will take you on a journey of how to track expenses for small businesses in five easy steps. But before we begin, you may want to check our article on how to automate your business.

Step 1: Open a business account

In order to keep an eagle’s eye on your business expenses, create separate financial accounts. Open a business checking account, savings account, and merchant services account for customer card transactions. This simplifies financial management and makes tax deductions easier by organizing all expenses in one place.

To achieve hassle-free expense management, get a separate card for business expenses. Having a dedicated business credit or debit card keeps your credit history organized, benefiting business financing and earning rewards like cash back on purchases and travel bookings.

Step 2: Choose accounting software

When tracking expenses for a small business, choose accounting software that can handle everything automatically and track each expense. Such software makes it easy to watch over and sort out expenses. Don’t worry about which software to use as we got you covered.In the next section of our guide, we will share some choice software with you. And the good news is you don't have to spend a lot of money to get accurate records because there are plenty of free accounting software options available for businesses.

During the account setup, decide whether you prefer cash accounting, which records transactions when payments are received, or accrual accounting, which records every bill and payment received.

Step 3: Link your financial institutions

Simplify expense tracking for small businesses by linking your accounting software to your financial institutions. With this, you can download all bank transactions automatically and effortlessly categorize spending. You can also integrate other functions, such as importing daily transactions, downloading bank statements, and making statement reconciliation a breeze.

Integrating your bank accounts with your accounting system allows you to complete banking transactions within the software, saving you time and ensuring an accurate income and expense record with no missed transactions.

Step 4: File your receipts

For accurate expense tracking for small businesses, file your receipts promptly as you conduct your business operations. The IRS requires you to keep all paper receipts and other relevant documents, like bank statements, for at least three years. Use folders to store paper receipts, and include the purpose of each purchase on the receipts. You can also label and organize folders based on dates or categories.

Modern technology has made tracking business expenses even more convenient through accounting software mobile apps and small business expense tracker apps that can be integrated with your accounting software. These apps store receipts digitally, allowing you to scan them with your phone's camera and securely store them in the cloud. The receipts automatically sync with your account books, simplifying the tracking process for each transaction.

Be sure to track all expenses, including mileage, flight expenses, and meals, and keep the receipts associated with them.

Step 5: Review your business expenses

To get the most out of it, the best way to track expenses for small businesses is to review them regularly. Examine the reports, analyze the numbers, and note any spending trends in specific areas. This analysis will help you understand how your expenses accumulate and enable you to make informed decisions for your business's growth. Additionally, correct any errors or omissions you might come across during the review process.

Also, it is not just enough to review your business expenses alone, it is important that you review your business to identify how current expense record affects the growth of your business.

The top 6 expense tracking tools for small businesses

Sorting receipts can be tedious and unenjoyable. We've compiled a list of the best business expense trackers that allow you to track your expenses online. If you prefer offline, we have an option.

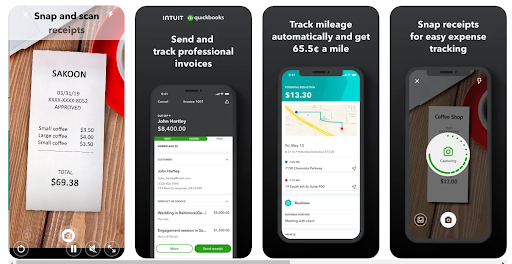

QuickBooks,

A comprehensive expense management tool tailored for businesses with accounting knowledge. Unlike other trackers on this list, QuickBooks offers a wide array of features. However, it demands more expertise, time, and effort to use effectively. With QuickBooks, you can handle various financial tasks, including payroll management, accepting online payments, tracking spending, and tax management. Certain aspects of QuickBooks might prove challenging for those unfamiliar with accounting or lacking sufficient time.

Nevertheless, you'll find great value if you're a QuickBooks expert or have a dedicated employee who can learn its functionalities. To simplify the process, you and your team can capture receipts by scanning them with your phone and loading them into the mobile app as part of an expense report. At the end of the month, reconcile the expenses and keep track of sales tax paid on purchases, which can be deducted from any sales tax owed.

QuickBooks is available on Android, iPhone, and web browsers, starting at $12.50 monthly.

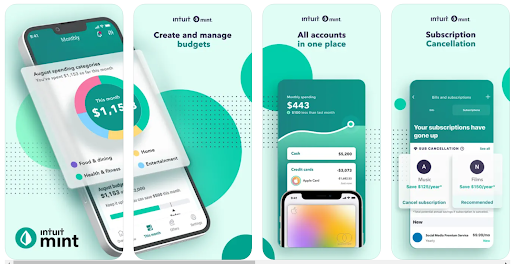

Mint

Mint is a popular and free expense tracker designed not just for personal use but also suitable for small businesses and freelancers. It helps you keep track of your expenses and lets you set budgets and financial goals. Additionally, you can monitor your credit score conveniently through the app's user-friendly dashboard. Stay well-informed about your financial status by setting up alerts for bill reminders, significant purchases, and other important events. You can access Mint on Android, iPhone, and web browsers without cost.

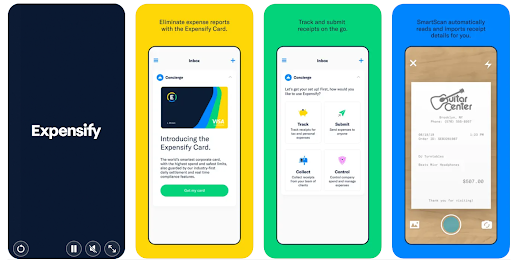

Expensify

Expensify comes in handy for business travelers and remote workers. No more worries about stuffing receipts into your luggage while on the move. Simply snap pictures of paper receipts with your mobile device and submit them through the app. Expensify even handles mileage tracking. Additionally, it automatically imports receipts from popular services like Uber and Airbnb. If you frequently use your company card, the app allows you to automate expense imports, saving you from the tedious task of going through statements after each trip.

Expensify is versatile in converting different currencies and integrates smoothly with most accounting software. On Android, iPhone, and web browsers, Expensify starts at $4.99 per month.

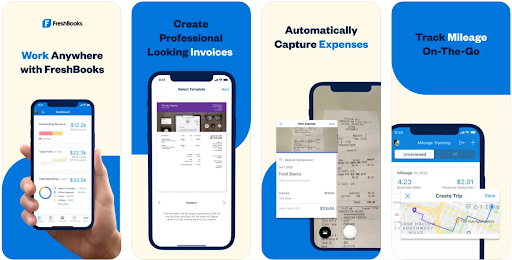

FreshBooks

FreshBooks is perfect for the no-fuss, minimalist entrepreneur. Say goodbye to complicated spreadsheets; inputting your business expenses is a breeze with FreshBooks. Whether on your computer or smartphone, their user-friendly interface allows you to add your spending effortlessly. The app provides basic reports, giving a quick overview of your profit and loss status. FreshBooks syncs with your bank account daily, automatically fetching recent transactions from your credit card or bank. You only need to reconcile them and attach photos of your receipts.

Available on Android, iPhone, and web browsers, FreshBooks starts at $15 per month (Bench clients get one month free).

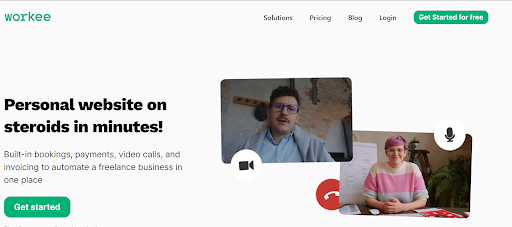

Workee

Workee is a software helping over 6,000 freelancers and professionals manage online businesses. It creates a personal website with built-in booking, scheduling, and payments in under 1 minute, streamlining work and client management. Users report saving 10 hours per week and thousands of dollars monthly with Workee.

There are two plans available: Starter and Pro. The Starter plan is free and designed for professionals starting out, offering basic website templates, one schedule, two-time slots, two Workee Projects, and three monthly invoices. The Pro plan, available with a monthly subscription, suits professionals seeking advanced features like professional website templates, custom SEO, unlimited schedules, time slots, invoices, and projects, and flexible booking rules for appointments.

Excel

With Excel, you can keep it simple by finding a suitable bookkeeping template and entering your expenses at least once a week. After inputting all your transactions, you can generate reports and gain insights into your financial data. For instance, you can transform your transactions into an income statement sheet, displaying your profit and loss over a specific period.

Excel is available on desktops and comes pre-installed on most computers, making it a cost-effective option.

To sum it up

For a small business, knowing how to track your business expenses gives you valuable insights into your financial health. To ensure no expense slips through the cracks, follow the necessary steps.

An organized expense record empowers you to make informed financial decisions and benefit from tax deductions and other financial aid for your business. As your business grows, monitoring how you spend and how it affects your profitability becomes very important.

Thankfully, Workee offers a solution that simplifies and quickens expense management. The platform comes equipped with built-in bookings, payments, video calls, and invoicing features, all in one place. By utilizing these tools, you can automate your freelance business and efficiently handle your financial records. This integration streamlines the process, making it easy for you to stay in control of your finances without much effort.