Planning for financial freedom and early retirement with Jill Wiley

A teacher’s reward may be in heaven, but it’s equally important to prioritize their financial well-being and plan for the future while on earth.

As an educator, you have done your labor of love and helped empower students to achieve their full potential. But what happens after you retire from teaching? Do you have a financial backing?

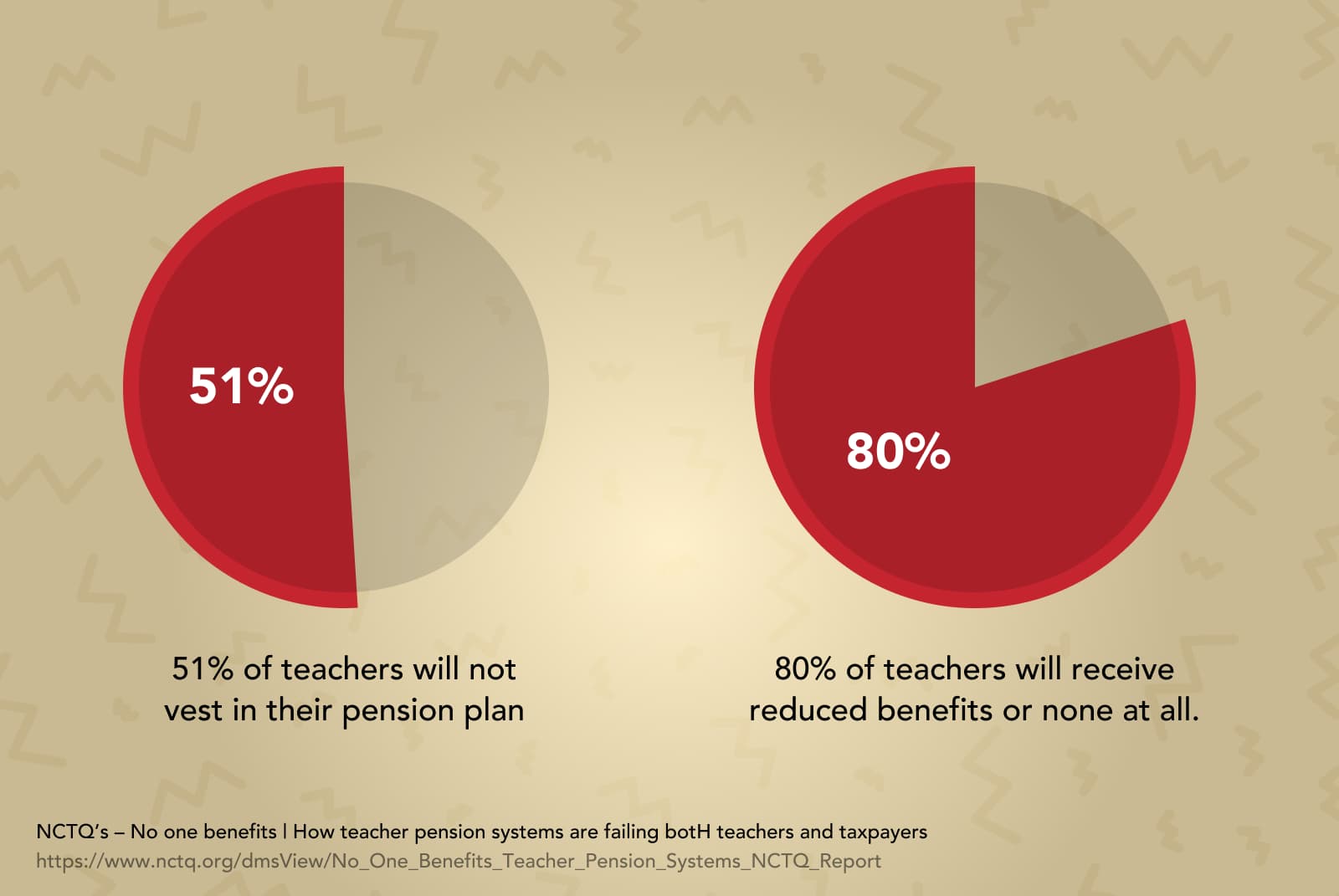

A study from the National Council on Teacher Quality (NCTQ) suggests that (51%) of teachers will not vest in their pension plan, meaning they will not qualify for employer-provided retirement benefits. The study highlights that only 20% of teachers will reach the pension plan's "normal retirement age" (the age at which they can collect full pension benefits), while the remaining 80% will receive reduced benefits or none at all.

Another report from the National Education Association (NEA) claims that the average teacher salary in the United States was $60,477, a figure that can impact the amount teachers can save for retirement. Furthermore, the NEA stated that, when adjusted for inflation, the average teacher salary had decreased by 4.5% over the previous decade.

These statistics and several more highlight that the pension systems need reform. Teachers need to stay informed, take proactive steps, and work towards a more secure retirement.

Workee experts spoke with Jill Wiley, founder of Classroom to Home, to discuss the key steps to achieving financial freedom and early retirement as teachers. So, please grab a cup of tea (or a glass of wine, no judgment here), and let's embark on this adventure together!

1. Can you please tell us about your background in education? What age groups have you worked with?

It’s safe to say that I started teaching before most of my current students were born. Maybe way before. Now, I teach at an international school in Norway. Most of my classroom teaching experience is with middle school and high school students, but when I offered Spanish on the side, I worked with ages preschool to adult.

2. What motivated you to become a teacher, and how long have you been in this profession?

I absolutely love learning. I considered being a psychologist for a while because I wanted to help people, but teaching is in my blood. My mom, grandma, sister, and several aunts and uncles are all teachers, so I tease that I just couldn’t escape. I started teaching in 1995.

3. What qualities or skills do you believe are essential for a teacher to be successful?

Teaching is about relationships. Your students need to feel comfortable but also motivated. Flexibility and a sense of humor are essential, too!

4. In your experience as a teacher, what have been the most rewarding and challenging aspects of your work?

Definitely, the most rewarding part is seeing the light in someone’s eyes when they achieve something they didn’t think they could do. At one point, I was teaching a Spanish class to daycare providers. Many didn’t take a language in high school because they weren’t considered “college material.” Since my methods are practical, they walked out of the first class to understand a simple story in Spanish. When they learned enough actually to understand something within just a few hours, they were so excited. Knowing that I am a part of experiences like that makes me fall in love with my profession again every day.

Definitely, the most rewarding part is seeing the light in someone’s eyes when they achieve something they didn’t think they could do.

5. Looking back on your career in the classroom, are there any lessons or experiences that stand out as particularly valuable?

Honestly, the most valuable experience has been when my students trusted me enough to share their stories and their experiences with me. I grew up pretty sheltered in a really small town, and I taught kids from some rough areas for a while. Because I had built a trusting relationship, they shared their hopes, fears, and heartbreaks, opening my eyes to a different world. I know it sounds cliche, but I learned way more from them than they did from me. I taught them French, Spanish, and English. They taught me about life.

The most valuable experience has been when my students trusted me enough to share their stories and their experiences with me.

6. What are your thoughts on the changing landscape of education and tutoring, particularly with the rise of online platforms and remote learning?

Remote learning and online platforms can provide access to learning opportunities that would otherwise be impossible for certain students, such as those with special needs or from rural areas. The issue comes when technology is used in ways that make it more difficult to make that human connection. For example, when the student-to-teacher ratio goes way up, students are treated more like products on an assembly line than individuals. So I’m really excited about the possibilities, as long as we don’t simply use tech as a cost-cutting tool.

Remote learning and online platforms can provide access to learning opportunities that would otherwise be impossible for certain students, such as those with special needs or from rural areas.

7. Can you share your thoughts on planning for retirement, particularly how to balance work and life?

Well, I’m still teaching 4 days a week, but for me, retirement is more about choosing whether to work for pay or not.

You’re going to be happier if you are running toward something instead of away from your job. You definitely want to have a plan for your money. Who wants to be stressed about paying bills when they’re 80? But you want to have a plan for your time, as well. Volunteering, sports, clubs, other activities, basically whatever you enjoy. But going from 0 activities outside your profession to total retirement is a big step.

The last thing you want to be stressed is about paying bills when you’re 80. You definitely want to have a plan for your money and time.

8. What are your tried and trusted strategies for financial freedom?

Well, no surprises here. Spend less than you make. Have a cash cushion in savings. Pay down debt, or better yet, avoid debt as much as possible. And max out retirement. This isn’t news.

But there’s another thing for teachers: boundaries. Teachers are such giving people that they often don’t have healthy boundaries with their time or money. They spend hundreds (sometimes thousands) of dollars on classroom materials and books. They work so many hours that they can’t get a side job - even though having one might help them get out of debt much faster. So for teachers, learning to set healthy boundaries is often essential to moving toward financial freedom.

Finally, we all know what to do for retirement. If not, see that first paragraph again. The hard part is doing it. And sometimes, if someone has struggled to have a healthy relationship with money, they might need to spend some time figuring out why? What does money mean to them? How do they feel when they spend money? Sometimes, to develop healthy habits around money, you have to dig into the reasons you have trouble making good decisions.

Maintain healthy boundaries, spend less than you make, have a cash cushion in savings, pay down debt, or better yet, avoid debt as much as possible.

9. How do you stay engaged and active during early retirement?

Well, as I said, I am still teaching, but my advice would be to define retirement for yourself, not by what others think it should be. One of the terms I coined was “Financial Independence, Temporary Retirement.” I’ve left teaching 4 times now and always returned more excited than ever. Taking breaks from teaching throughout my career has made me a much better teacher - and a much happier person. Re-defining retirement to fit your life and needs is the best thing you can do.

10. What advice would you give new tutors or educators starting their careers?

My best money advice is to max out your retirement. If you can’t max it out, put absolutely as much in it as you can every single month. That means it is a line item in your planning. It goes out before you pay bills, eat out, or whatever. If you start that when you are young, you won’t be at the mercy of your state pension plan.

My best non-money advice is to set healthy boundaries. Know your worth, and don’t let others (especially your employer) convince you that they own your life.

Thank you, Jill, for sharing your insights and supporting Workee!

Check out Jill's website for more information on her work, and you can also connect with her on Facebook.